Ladies, let's talk.

I know you have a ton going on, and you're busy with whole world of must-extinguish-four-alarm-fires — but this can't wait. As your self-proclaimed financial mentor, I need to make sure you understand how important it is to get yourself into a position where you can be regularly saving and investing for the long-term. Here are a few facts we all know, but may not have considered together:

1. On average women live 5 years longer than men.

2. Women are paid 17% less than men for equivalent work.

3. Along with the pay gap, women make “less than men because they shoulder more of the family burden,” [New York Times]

4. 50% of marriages end in divorce.

I could get lost in the details of each one of these points — but when you put them together, for me it all adds up to a giant, red-flashing warning sign with sirens and flag-wavers blaring trumpets saying that not only do we women need to save more — but those savings need to be invested for long-term growth to protect us when we're old and flying solo. We need to be competent and educated when it comes to the topic of money in our families because whether our marriages stay together or not, we're likely to outlive our spouses, and eventually be making important financial decisions on our own. Or, if we’re in same sex marriages, we’ll have two longer lives to save for. The way I see it, our future health, happiness, and wellbeing depends on our financial savvy now.

Women need more money because they live longer, but statistically they make less. Simple math would conclude that to account for these two opposing factors women need to save more vigilantly and grow those savings more effectively than men who generally earn more, die younger, and often benefit from having their spouses as caretakers in their final years.

This is not news to most of us, so what are we waiting for?

There's another part of the puzzle

I know bringing this up isn't necessarily enough to get the ball rolling. Knowing is only one part — we also need to be in the right frame of mind to absorb the information, recognize how it may affect our lives, and make the decision to act on our own behalf. And if we're not mentally ready, we're not going to do it.

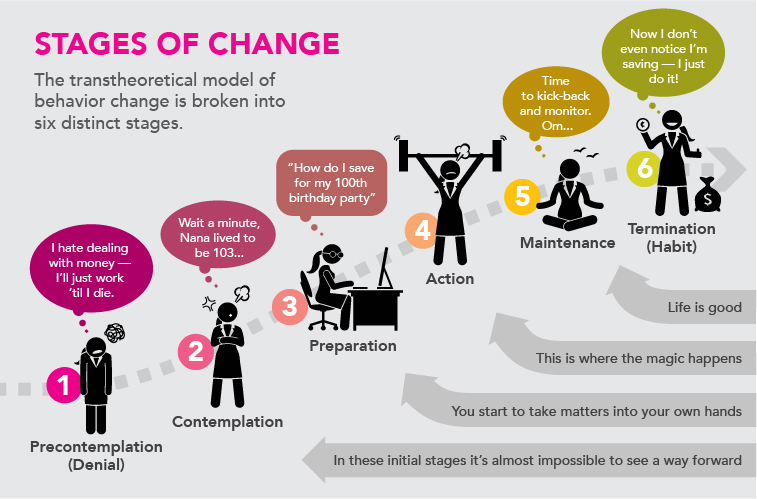

I recently attended a lecture on behavioral finance by Dr. Sonya Britt, a professor at Kansas State University, who opened my eyes to something that now seems incredibly obvious — but had confused me for years. She explained that there are distinct psychological stages we go through before we can take positive action to change our behavior:

Being given information that suggests how beneficial saving and investing is, won't magically transport you from 'precontemplation' to the 'action' stage. Instead, you need to climb through each stage, allowing your perspective to evolve to the point that you’re ready for ‘action’.

I have spent years wondering why, when faced with the facts, people don't stop what they were doing and immediately go open a Roth IRA, or recognize that the damage of credit card debt far exceeds the benefits of excessive spending. But now I understand that when it comes to money, some of us reached the 'action' and 'maintenance' stages years ago — and not everyone is there yet. If a sensible option is staring you in the face while you’re still ‘precontemplating’ — no matter how much sense it makes, you’ll likely look right through it.

But here's the good news

I've seen people move from 'contemplation' to 'preparation' and then on to 'action' with rapid recognition and powerful results — not because they've been given a magical formula — but because taking action suddenly makes sense and no longer seems so intimidating. The anxiety of 'precontemplation' fog fades, and the path forward becomes a clear set of steps to take, one foot in front of the other.

And studies have shown that women are more successful at investing than men

Of course, this isn't a competition, but I want you to understand that this is not only doable — investing could be one of your strengths. Dr. Terrance Odean, professor at Berkeley's Haas School of Business found a pattern of excessive trading in men's investing style which adding-up a 1% reduction in annual returns when compared with women. The irony of his study is that the unsuccessful behavior in men was attributed to an overactive overconfidence, whereas women’s more successful buy and hold style stemmed from a lessor sense of confidence… Ladies, even if you don’t realize it, we’ve got the disposition to be great investors! And 1% might not seem like much, but compounded over years will have a huge effect on retirement assets, and is an enormous penalty for bad habits.

So, what's it going to take to get you to 'action'?

Believe me, I understand that your plate is full — because as women, the world rests on our capable shoulders. But unfortunately, just because carving out the time and attention to learning the basics of investing is inconvenient, that doesn't mean the above statistics won't apply. Having been through a divorce myself, and seen my work and career interrupted and radically changed by the birth of my daughter — I know all too well how easy it is to become derailed in your ability to earn and save.

But one of the tools I had during those transition times was my investment portfolio — established with money I had set aside in my twenties that I thought was too little to matter. In my time of need, that handful of dollars had grown, and swooped-in like a hero to see me through the rough patches.

To me, my investments provide safety and strength and choice, even though I try never to touch them. Just knowing they're working away in the background is comfort enough, and is why I want to help as many women as possible develop the confidence to invest and grow their own resources.

And there’s one more reason: Investments returns are gender blind, and there’s no pay gap in compound interest. If you want to know what it feels like to earn like a man — start investing.

Here's the hard question

How long do you want to 'precontemplate', 'contemplate', and 'prepare'? These are legitimate phases of our journey — we have to go through them — but they can come at an expensive opportunity cost. When you're not productively moving forward, it's possible you could be digging a deeper hole that you'll later need to make more of an effort to backfill.

When wondering who's going to pay the bills when I'm 80, and I like to think it's my 25-year-old self — because investing is a way to take the money you've already earned and give it a job in the future. And at the moment when I can't or don't want to show up at work anymore, I'll be glad to have an army of previously-worked hours, put in over a lifetime, that will pick-up the slack.

So how about you? At what age are you going to start taking care of your future self? Ladies, no matter what stage you’re at, I want you to know that I am committed to helping you get to ‘Action’. I created a downloadable workbook Game Your Brain Through the Stages of Change to get you started.

very best,

Christina

P.S. What's my favorite way to save and invest for the long term? The beautiful and majestic Roth IRA — of course!

DISCLOSURE

The foregoing content reflects the opinions of Insight Personal Finance, LLC and is subject to change at any time without notice. Content provided herein is for informational purposes only and should not be used or construed as investment advice or a recommendation regarding the purchase or sale of any security. There is no guarantee that the statements, opinions or forecasts provided herein will prove to be correct.

All investing involves risk, including the potential for loss of principal. There is no guarantee that any investment plan or strategy will be successful.